One of the biggest risks businesses take is providing goods and services without payment. While this is the way things are often done in business, that doesn’t mean there isn’t another option. Instead, you could choose to require advance payments for your goods and services, or just for certain projects. Unexpired or prepaid expenses are the expenses for which payments have been made, but full benefits or services have yet to be received during that period. Yet the supplier hasn’t delivered any services or products to you, and you haven’t benefited in any way. The payment is liable to the supplier, ou have paid for something and they still owe you.

How to account for customer advance payments

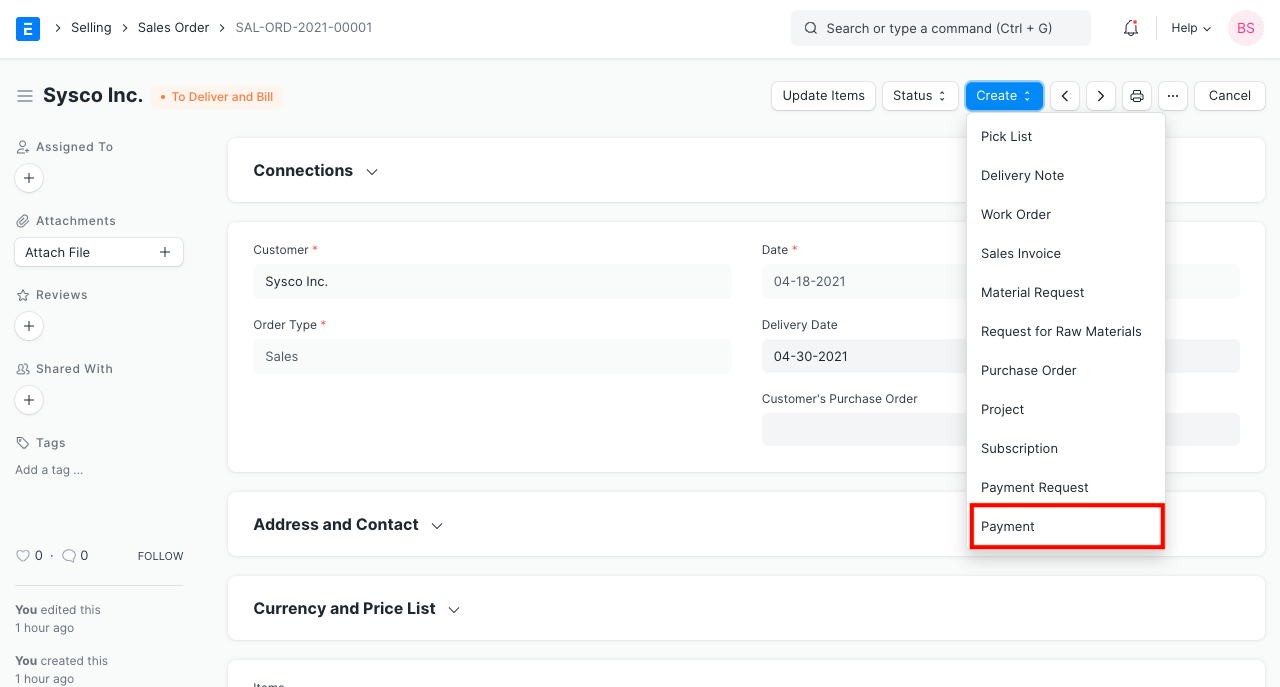

Keep hard copies on file for at least a year while digital files should be maintained for at least seven. Not paying attention to correctly allocating the amounts can land you in hot water when the tax year winds to an end. The process of documenting customer advances in QuickBooks Online starts with verifying that the customer is listed in QuickBooks. If not, visit the Sales section and select Customers to generate a new customer profile.

Related AccountingTools Courses

It is a 50/50 risk where the project could either run without a hitch or the vendor could head for the hills with your money, leaving the project incomplete. It is seen that as of March 31, 2023, the company reports $1.8 billion in deferred revenue concerning customer deposits for scheduled vaccine delivery in 2023. Apparently, it anticipates $1.2 billion of revenue recognition within the following year. Sales recognition for COVID-19 vaccines is contingent upon factors such as product delivery, manufacturing, and marketing approval timing.

Advance payment to supplier

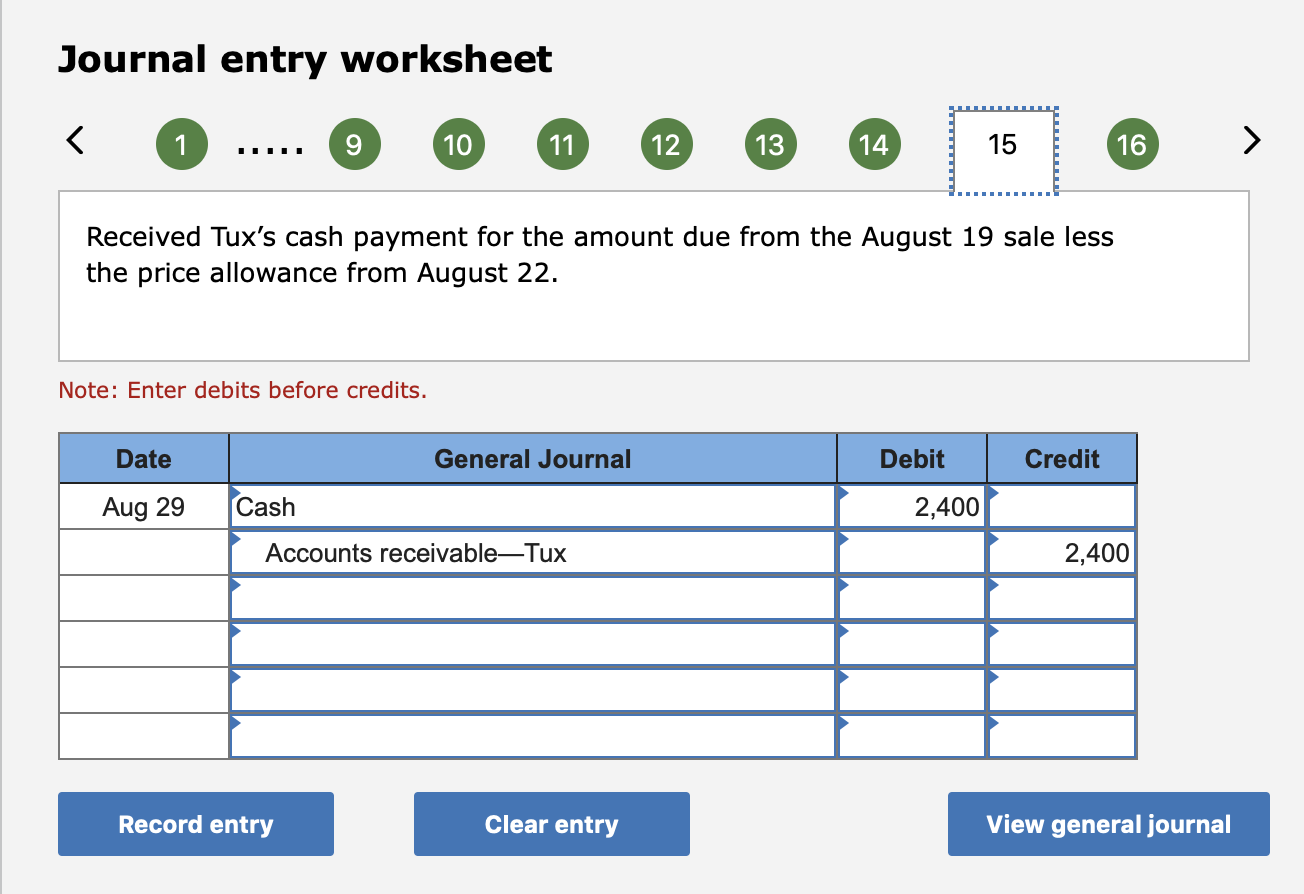

In this journal entry, both total assets and total liabilities on our balance sheet increase by $600 at the same time for the advance payment that we have received from the customer. The customer deposit of $ 30,000 needs to reverse to revenue as the company has already completed the obligation. However, customers need to pay an additional $ 70,000, which is recorded as accounts receivable on seller’s balance sheet. When the company paid cash in advance, it must be recorded as assets on the balance sheet. Most of the time, it is recorded as cash advance which is the current assets. We are not able to record it as an expense or the purchase of assets.

This is because the seller still has an obligation to provide the service or deliver the goods, even though it has been paid in advance by the customer. Once the service has been provided or the goods have been delivered, then the liability can be recognized as revenue. Another advantage of paying cash in advance is that it often secures better pricing from the vendor. They have the customers’ money locked in, so they are able to provide a good price with good credit terms. This can be a significant saving, especially if the company makes a large purchase.

- Advance payment is very important for small businesses, as they help you understand your cash flow better for each project.

- When the work is completed, invoice the customer with the advance payment subtracted from the total cost.

- When he paid this premium, he debited his insurance expenses account with the full amount, i.e., $4,800.

In this journal entry, the unearned revenue account is a liability account on the balance sheet in which its normal balance is on the credit side. This unearned revenue account represents a liability that we owe to our customers. We need to fulfill this obligation in the future by providing the goods or services to our customers in order to convert this unearned revenue into earned revenue.

This $600 advance payment represents 30% of the $2,000 total fee that we charge on the consulting service that we will provide in January. And we will receive another 70% after completing the consulting service at the end of January. The company needs to record the advance received as the liability on the balance sheet.

Suppliers need to ensure payment collection before providing services or goods. It may damage the relationship with the customer, but it helps to prevent loss when customer cannot settle the accounts receivable. The company has required the customer to make an advance payment before delivering the goods. The more money you have going into your business, the easier it is to allocate funds for capital investments, pay your bills on time and retain positive relationships with your suppliers. The trouble is that it can often seem as though funds are leaving your business faster than you can claw them back. If you don’t already have a customer account with the vendor, open one!

It will not be qualified as an expense if the goods or services are delivered and invoiced at a later date. You should be supplied with a detailed list of all the materials your supplier needs to complete the project. And as the company requesting the work, you should make sure the supplier has purchased all the materials before they begin working, you would have given them the money to do so.

The company requires the customer to deposit before placing an order with the supplier. There are many reasons why a company might request a cash advance from a customer. If a company is expecting a large amount of orders, it may ask for an advance payment to cover the cost of purchased items. If you’re interested in finding out more about advance payments, the right way to account for them or any other aspect of your business finances, then get in touch with our financial experts. Find out how GoCardless can help you with ad hoc payments or recurring payments.

When a customer pays a deposit for goods that will be supplied at a later date. Generally, amounts received as ‘advance payments should be recognized as a liability rather than as revenue. In summary, a customer payment journal entry involves recording instructions for form 9465 the initial receipt of cash or bank transfer as a liability in the “Customer Advances” or “Unearned Revenue” account. Once the goods or services are delivered, the liability is reduced, and revenue is recognized through a corresponding journal entry.