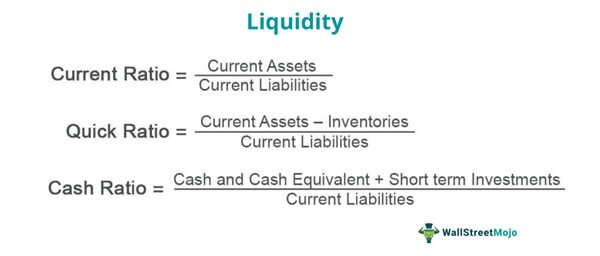

Investors analyze liquidity ratios to evaluate the financial stability of a company before making investment decisions. Liquidity ratios are an important set of financial metrics used to analyse a company’s ability to cover its short-term obligations. Though these liquidity ratios may be considered simplistic, they’re instrumental in determining if a company will survive adverse economic conditions. The total assets are divided by the total current liabilities and then multiplied by 100 to give you an acid-test ratio.

What Happens If Ratios Show a Firm Is Not Liquid?

- A higher current ratio around two(2) is suggested to be ideal for most of the industries while a lower value (less than 1) is indicative of a firm having difficulty in meeting its current liabilities.

- This suggests that the company can technically cover its short-term liabilities with its current assets.

- An institution shall fully post collateral at the central bank, which, after being subject to any haircut applied by the central bank, shall at all times be equal to or greater than the maximum amount that may be drawn on the credit line.

- Although examining organizations’ profitability and efficiency is crucial, liquidity risks remain very real and serious, as demonstrated by the 9/11, Lehman, and COVID crises.

For small businesses, maintaining a healthy liquidity ratio is crucial for ensuring operational stability and financial flexibility. A higher liquidity ratio generally indicates that a small business has enough liquid assets to cover its short-term liabilities, which is vital for sustaining operations, especially in times of financial uncertainty or slow business periods. By using these liquidity ratios, investors can determine whether a company has enough cash on hand to pay its immediate bills. If a company fails any of these tests, it is considered “liquidity challenged.” This means that it either has insufficient cash on hand or too many short-term liabilities (payables) to pay its bills.

Ask a Financial Professional Any Question

For example, suppose a country has 1,000,000 active duty military personnel and a total land area of 3,000,000 square kilometers; its basic defense ratio would be as given below. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. A Liquidity Ratio that is consistently below 1.0 may also be an indication of financial distress and could lead to bankruptcy or insolvency in the near future. A programmer by trade, Nick is a freelance writer and entrepreneur with a penchant for helping people achieve their business goals. He’s been featured on Popular Mechanics & Apple News, and has founded several successful companies in e-commerce, marketing, and artificial intelligence. When he’s not working on his latest project, you can find him hiking or painting.

Article 22 Definition of Liquidity Outflows

A company can have sufficient money on hand to operate if it’s built up capital; however, it may be draining the amount of reserves it has if operations aren’t going well. Alternatively, a company may be cash-strapped but just starting out on a successful growth campaign with a positive outlook. For instance, you can compare Microsoft’s current ratio against Google’s current ratio to gauge how each company may be structured differently. This can be an important part of deciding between companies to invest in, especially if short-term health is one of your primary considerations. An institution shall fully post collateral at the central bank, which, after being subject to any haircut applied by the central bank, shall at all times be equal to or greater than the maximum amount that may be drawn on the credit line.

Comparing the liquidity ratios of different companies may not always be comparable, fair, or truly informative. One of the primary advantages of liquidity ratios is their simplicity and ease of calculation. Comparing previous periods to current operations allows analysts to track changes in the business. In general, a higher liquidity ratio shows a company is more liquid and has better coverage of outstanding debts.

Liquidity ratios analysis

The basic defense ratio measures the ability of a nation’s military forces to defend its territory by comparing active military personnel to the size of the country. It is calculated by dividing the number of active duty military members by the total land area of the country. For example, suppose a company has Rs.50,000 in cash, Rs.20,000 in Treasury bills, and Rs.80,000 in accounts payable; its absolute liquidity ratio is given below. A ratio greater than 1 means the company has more debts than assets, which indicates high risk.

Accounting ratios are important because they assist the management in their day to day financial decisions. They also help them evaluate the performance of the firm and make any changes that are deemed necessary. One aspect that the management has to focus on is to ensure that the firm maintains a certain level of liquidity. It means that this company collected its accounts what are accrued expenses and when are they recorded receivable 2-times faster than it sold credit and had an average AR balance of just one-fifth of its annual credit sales. The acceptable range of cash ratio varies by industry, and it is usually between 0 and 2. Some industries require the companies to hold even more of their assets in cash, such as utilities and telecommunications, where the acceptable range is 0 to 1.50.

Liquidity ratios are important because they provide crucial insights into a company’s financial health and flexibility by measuring its ability to meet near-term obligations. Liquidity analysis helps investors assess risks, opportunities, and cash flow potential when evaluating stocks. Low liquidity signals heightened bankruptcy risks, while strong liquidity indicates financial durability and ample cash available for growth after short-term needs are met. Investors favor stocks with robust liquidity as they demonstrate flexibility to pursue opportunities even in downturns.